FDJ acquires Irish lottery; sees revenue hit €1.28bn but EBITDA falls 3%

The French gambling monopoly has posted its H1 report, showing rises in revenue and net profit but a drop in EBITDA.

By Matthew Nicholson

Key highlights

– Revenue rises 6% annually

– However, EBITDA falls 3%

– Net profit totals €181m

– Share price falls to 2023 low following the report

– FDJ acquires Premier Lotteries Ireland for €350m

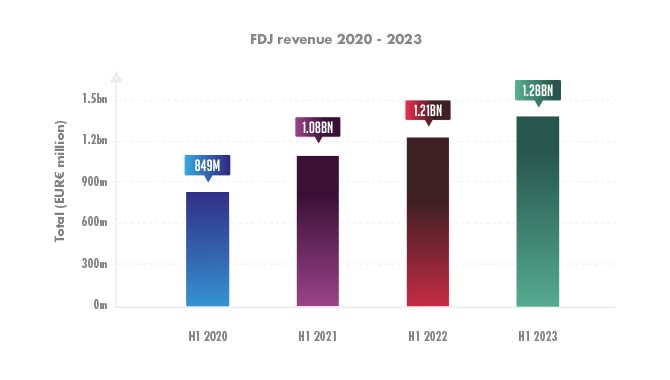

Groupe FDJ has posted its H1 results for 2023, showing a 6% increase in its revenue – totalling €1.28bn ($1.40bn).

Its revenue increase from €1.21bn in H1 2022 continues a trend that saw a 12% increase from H1 2021 to H1 2022 – and can be seen summed up in the graph below.

What becomes clear is that FDJ’s revenue increases have halved every annual H1 since 2020, showing a slowing of revenue gains for the French monopoly.

Meanwhile, its EBITDA fell by 3%, reporting €300m in H1 2023 against €308m in H1 2022. The drop is somewhat surprising because of the rise in revenue; however, FDJ stated in its report that its EBITDA has been ‘adjusted for depreciation and amortisation expense.’

Since 2020 (and until 2023), FDJ’s H1 EBITDA had increased year-on-year – 26% from 2020 to 2021 and 18% from 2021 to 2022.

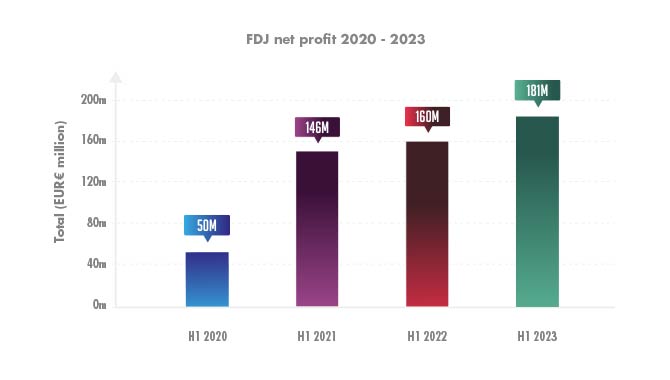

Meanwhile, its net profit grew in H1 2023, totalling €181m against €160m in H1 2022 – representing a 14% increase. The graph below shows how FDJ’s net profit has unevenly grown since 2020.

Within its past four H1 reports, FDJ has seen wildly varying increases in net profit, with 2020 to 2021 seeing a huge 190% rise, while 2021 to 2022 saw a much lower 9% increase.

As a result of its report, FDJ’s share price plummeted from €35.46 to €33.60 – representing the most significant fall in the past month, meaning the price is now at its lowest since the beginning of the year (which began at €38.17).

The high for the year came on April 18, when its share price hit €40.22 – coming a day before FDJ dropped its Q1 report.

Finally, its recurring operating profit shows a similar level of unstable numbers to its EBITDA. For H1 2023, the recurring operating profit totalled €240m, 2% down on the previous year. However, its H1 2020 to 2021 posted a rise of 60% – while from 2021 to 2022 the rise was cut by over half to 24%.

Commenting on its H1 report, Stéphane Pallez, Chairwoman and CEO of the FDJ Group, said: „FDJ recorded solid results in the first half of the year, driven by a good increase in stakes in our network of 30,000 points of sale, a sustained dynamic in digital stakes and the integration of new activities.”

FDJ acquires lottery

Alongside the news of its H1 report, FDJ also revealed it had acquired Premier Lotteries Ireland, which holds exclusive rights to operate the Irish National Lottery until 2034, for €350m.

Although this news wasn’t enough to save the decline of its share price, the further diversification of the French company’s business outside of France may have spared a worse impact in the short term.

Speaking of the deal, Pallez added: “I am very pleased to welcome Premier Lotteries Ireland, a long-lasting partner of the Euromillions community, within the FDJ Group for our first venture as a lottery operator outside France.”

Zdroj:www.gamblinginsider.com

Shrnutí

Groupe FDJ has reported its H1 results for 2023, showing a 6% increase in revenue to €1.28bn ($1.40bn). However, EBITDA fell by 3%, totaling €300m in H1 2023. Net profit grew by 14% to €181m. FDJ’s share price fell to its lowest level of the year following the report. FDJ also acquired Premier Lotteries Ireland for €350m, diversifying its business outside of France. The company’s H1 results have shown varying growth in revenue, net profit, and EBITDA since 2020. Chairwoman and CEO Stéphane Pallez commented on the strong results and the integration of new activities.